User Portfolio

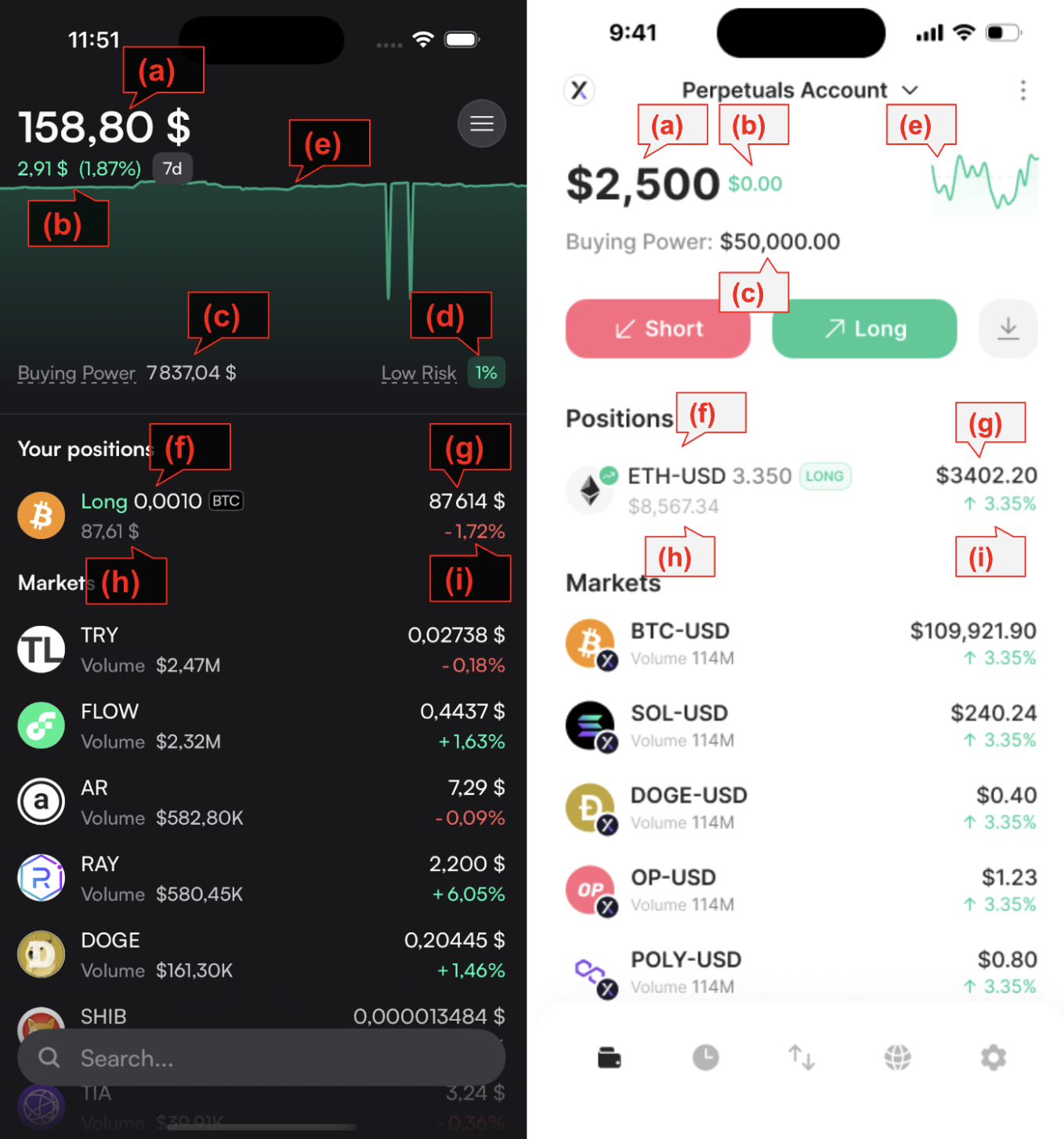

After onboarding to dYdX and depositing funds, the app displays the portfolio view. Once the user places a trade, the app updates to show open positions.

Portfolio Data Display Fields

(a) Account equity:

Indexer data from the websocket v4_parent_subaccounts channel. response.

This is equity of subaccount 0 (e.g., the sum of all child subaccount equities).

(b) Account PnL:

Account PNL of the selected time range (e.g., it’s “7 days” on the screenshot).

Indexer data GetHistoricalPnlForParentSubaccount. Sample curl request:

curl --location 'https://indexer.v4testnet.dydx.exchange/v4/historical-pnl/parentSubaccountNumber?address=dydx1k93udthd0vtzjk465f846qzea3fzq7axnmfqyz&parentSubaccountNumber=0'(c) max buying power:

The endpoint returns the PNL ticks of the given time range. The value is the difference between the last and first tick.

Account level buying power. The Indexer provides data via the WebSocket v4_parent_subaccounts channel. response.

Calculate max leverage

Each market has a configured maximum leverage factor ranging from 1x to 50x. The leverage factor is derived from the initialMarginFraction field in the market info received from the WebSocket v4-markets channel.

max leverage = 1 / initialMarginFractionMax Buying power

The max buying power is then calculated as follows:

- Take the

freeCollateralofsubaccount 0 - Multiply it by the

maximum leverageacross all markets (50x)

This represents the user's maximum buying power if all remaining free collateral is applied to the market with the highest leverage.

(d) Account level risk

The account-level risk is derived from Indexer data via the WebSocket v4_parent_subaccounts channel. sample response.

This metric represents the percentage of the user's total collateral that has been allocated to support open positions (also referred to as margin).

The account-level risk is derived from Indexer data via the WebSocket v4_parent_subaccounts channel. sample response.

To compute total collateral, follow these steps:

Collateral per position

Calculate the collateral for each open position:

position collateral = (current value of the position) * leverage = (position size * current oracle price) * leverageSum collateral

Sum up the collaterals for all open positions.

Total collateral

Add the USDC asset position of subaccount 0, which represents the remaining USDC balance that hasn’t been used as collateral for open positions.

The resulting total collateral is then used to determine the margin percentage, reflecting the level of risk associated with the account’s open positions.

(e) Historical PNL. Indexer data GetHistoricalPnlForParentSubaccount. The chart shows the PNL tickets of the selected time range.

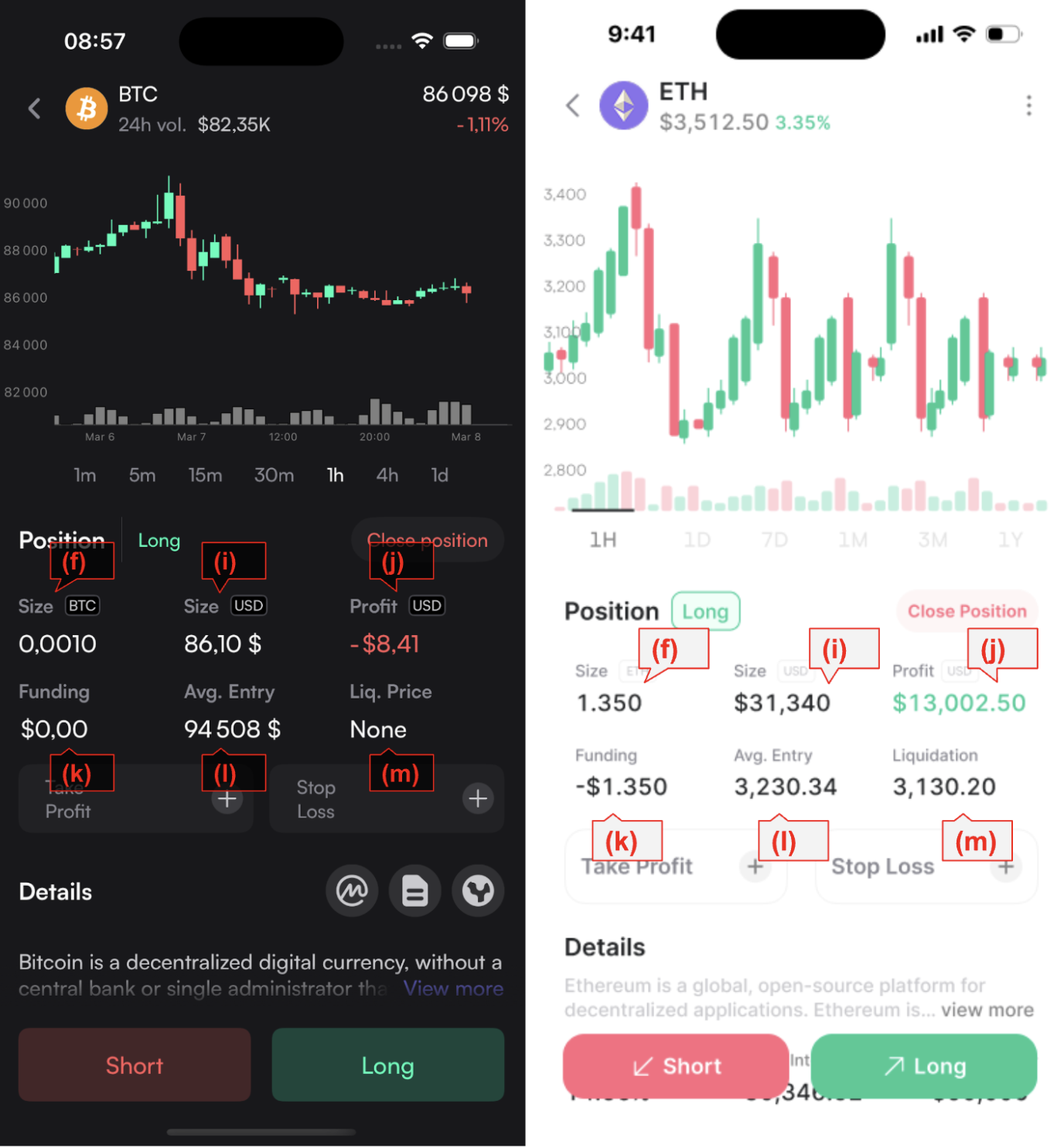

(f) Position size, and position side Indexer data from the websocket v4_parent_subaccounts channel. sample response. Subaccount -> ChildSubaccounts -> openPerpetualPositions -> size/side.

(g) Current oracle price. From market data off the Websocket v4-markets channel.

(i (img 1)) Perp 24h price change percentage: From market data off the Websocket v4-markets channel, priceChange24H field of childSubaccount.

(i (img 2)) Position USDC size. Position size * oracle price

(j) Position PNL. (Position size * oracle price) - (Position size * entry_price)

(k) Current funding rate. netFunding, of childSubaccount.

(l) Entry price. entryPrice, of childSubaccount

(m) Liquidation price. When the market price moves across this estimated price, the user's position would be liquidated. See margining requirements

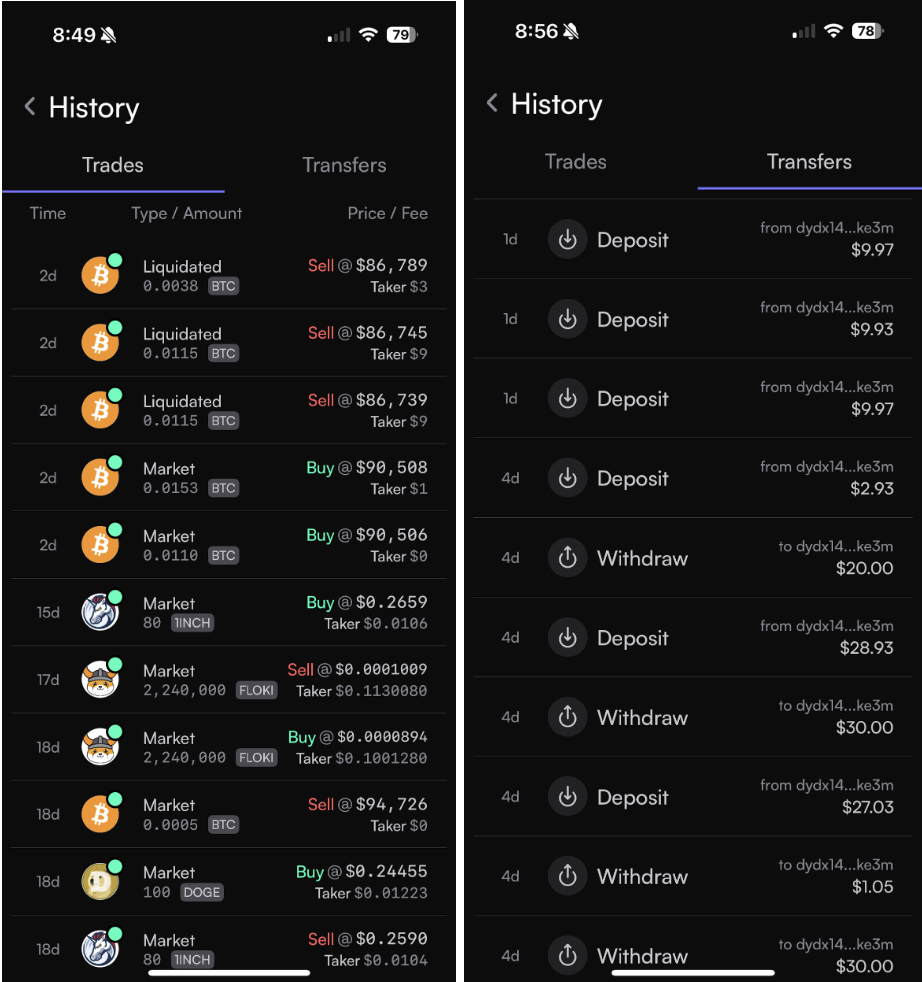

History

The trade history data come from the Indexer’s getfillsforparentsubaccount endpoint. Transfer history data come from the Indexer’s gettransfersforparentsubaccount endpoint.